Designed a self-service claims dashboard that cut support calls by 10%

Customer service was receiving hundreds of calls asking about claims. Policyholders needed status updates, adjuster contacts, and next steps—but our online tools didn't provide those answers.

I built a dashboard where users can check claim status, upload documents, and contact their adjuster—turning a 10-minute phone call into a 30-second self-service check.

Impact:

10% fewer support calls

100,000+ customers now use the self-service features

Worked with Customer Service, Claims Managers, and dev teams to ship product

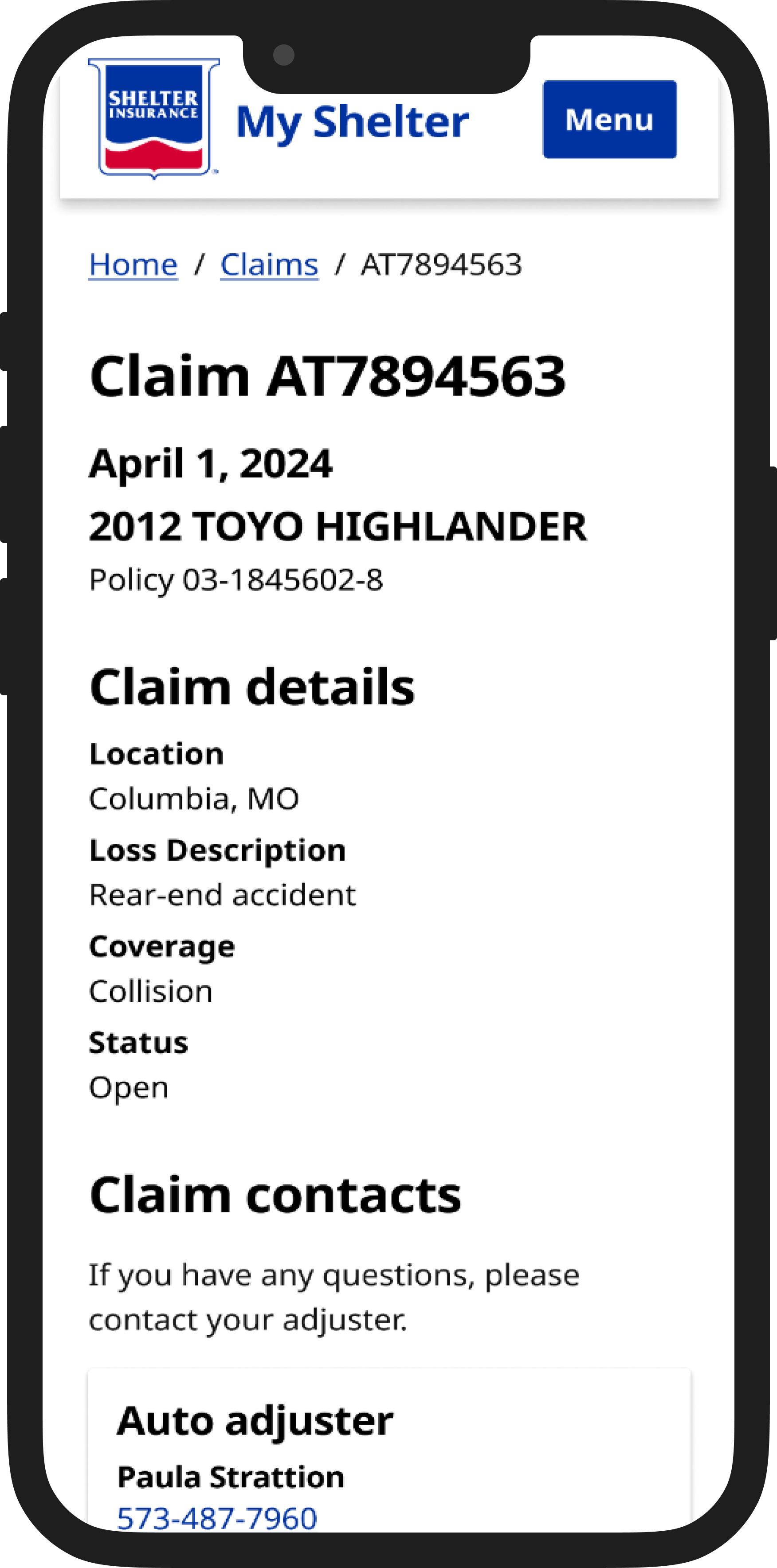

Prototype walkthrough of claims dashboard.

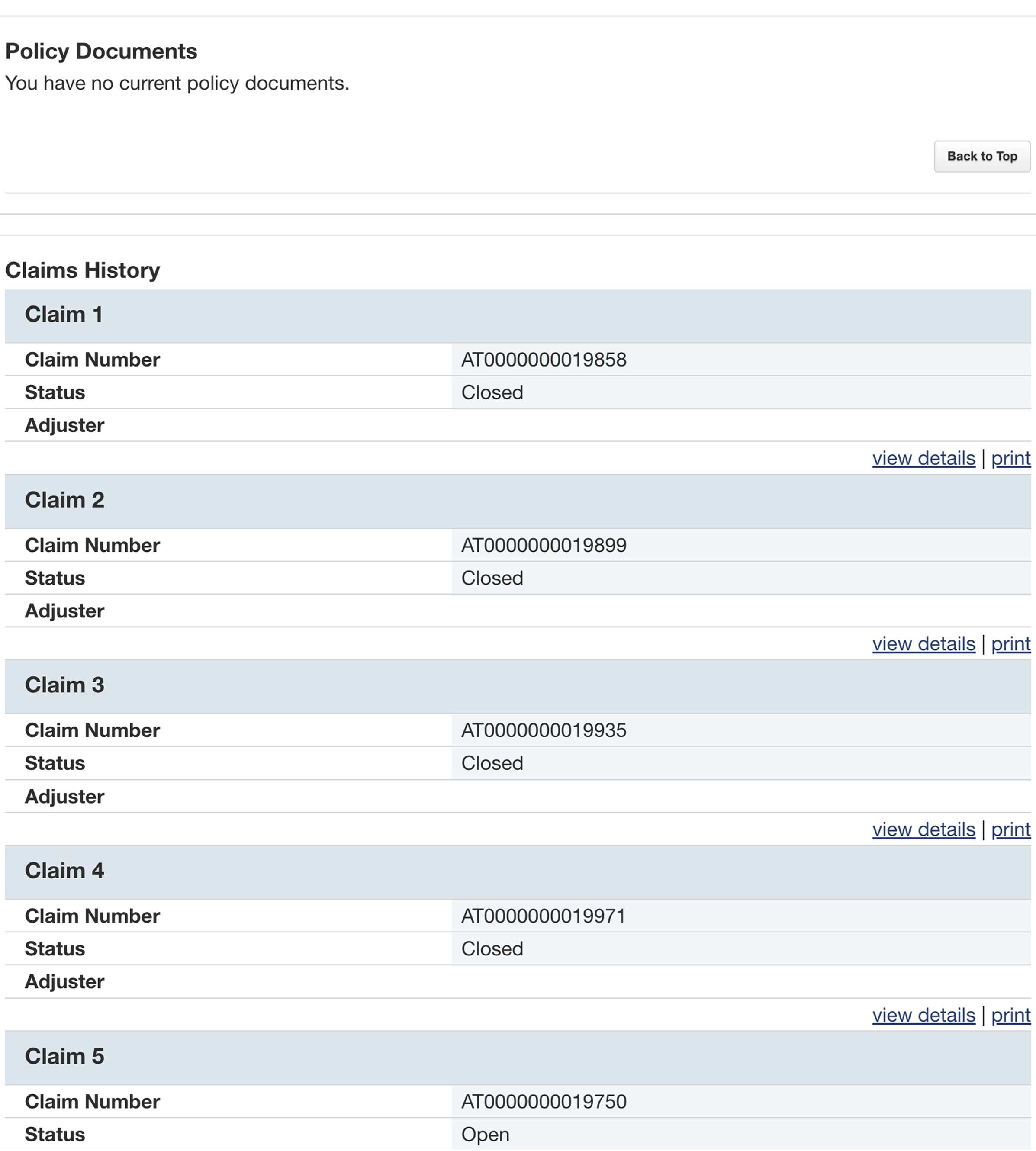

Finding claims required scrolling through policy details

Claims section appeared only after scrolling past policy details.

The Claims and Support teams approached us to address a critical challenge—making claims information easier to find and use

Our analysis revealed several usability barriers that made claims navigation confusing and time-consuming for customers:

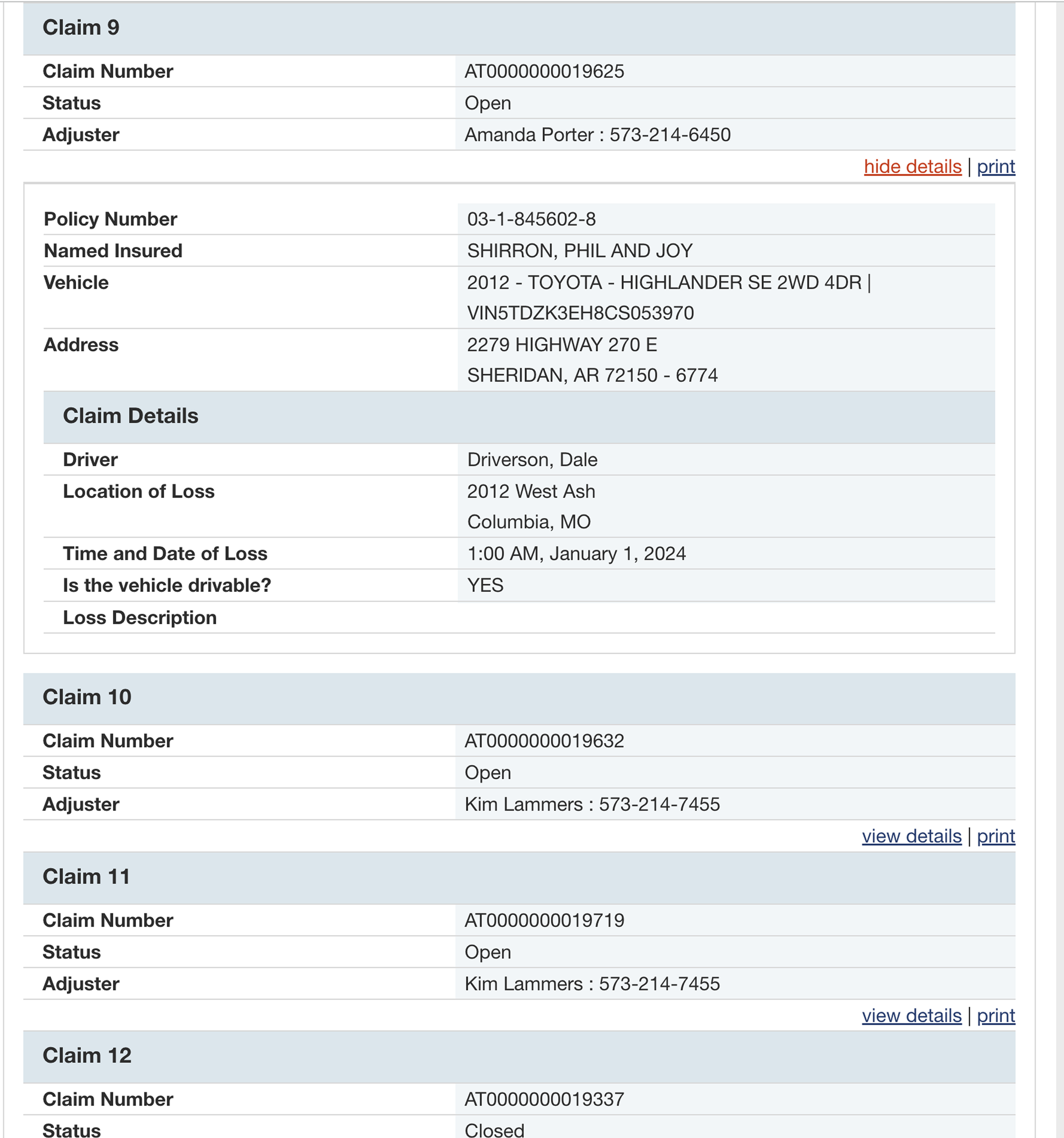

Customers struggled to locate their claims information

Key claim details were buried in collapsed tabs at the bottom of policy pages

Customers didn't understand how many adjusters were working on their claim or who they were

Transforming claims navigation from confusion to clarity

I mapped both customer and internal workflows to see where the disconnect happened. The customer flow revealed confusion at every touchpoint—no email confirmation, unclear next steps, and no visibility into who was managing their claim. Meanwhile, the Shelter flow showed adjusters struggling with fragmented systems and unclear handoffs.

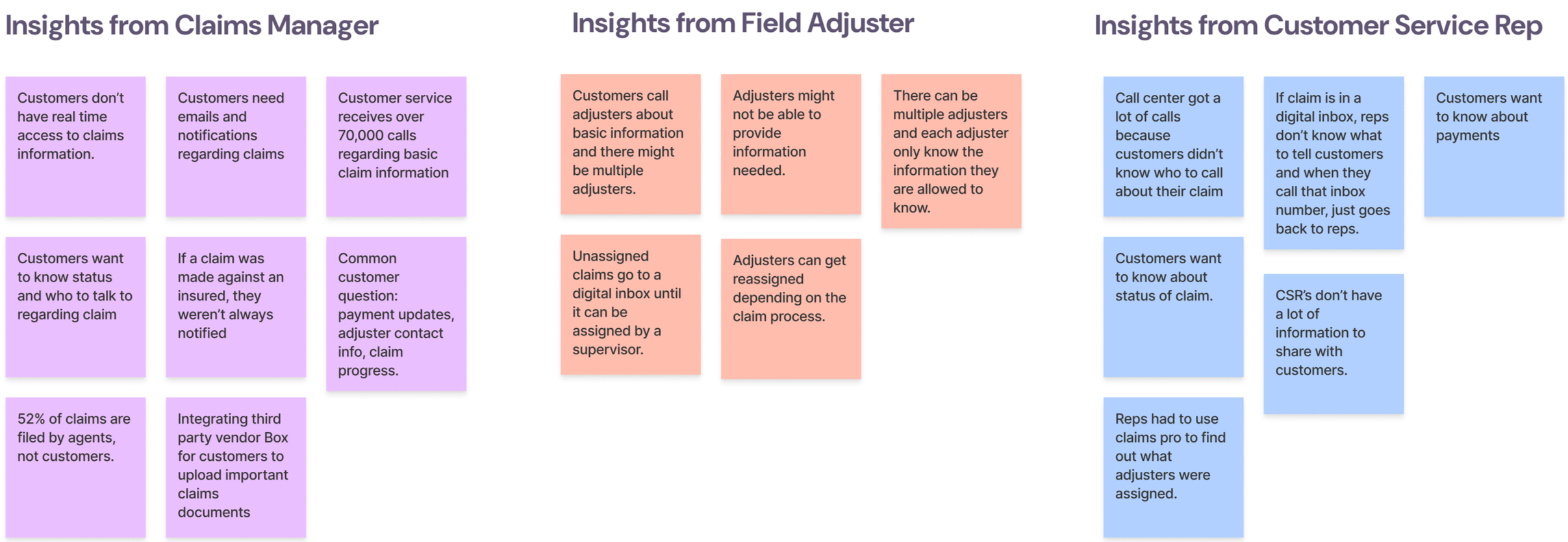

8 stakeholder interviews revealed where the system was failing

Redesigning workflows and content to help insureds understand their claims journey

I interviewed claims adjusters, management, and customer service to understand the complete claims ecosystem—not just what customers saw, but how the backend really worked.

Key Insights:

Customers relied on phone calls for basic claim information that should be available online

High call volume around claims inquiries was overwhelming the call center team

Customers lacked access to real-time updates about claim status and adjuster changes

“In 2022, about 25% of calls that the call center received were regarding claim inquiries, which equated to over 70,000 calls.”

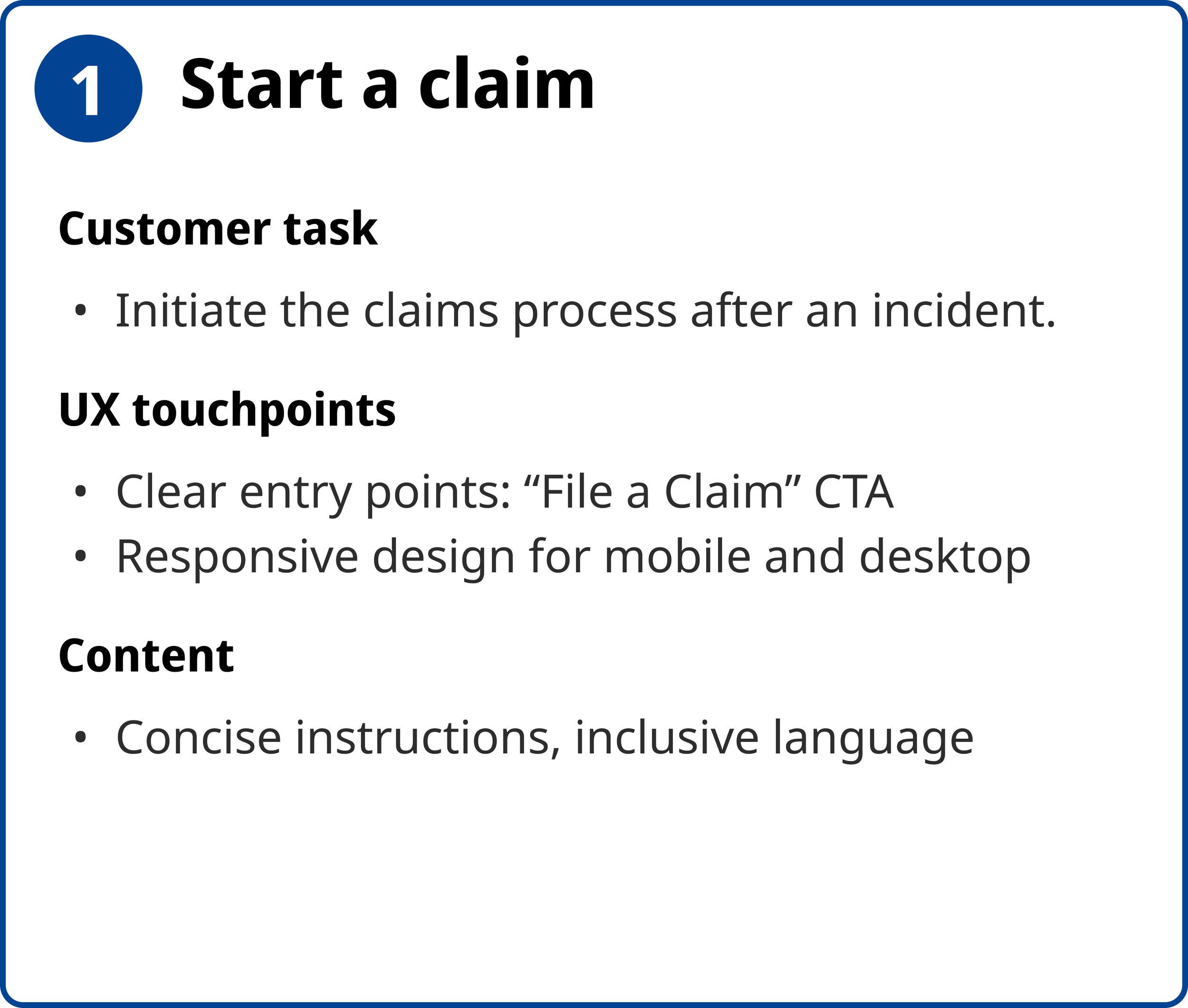

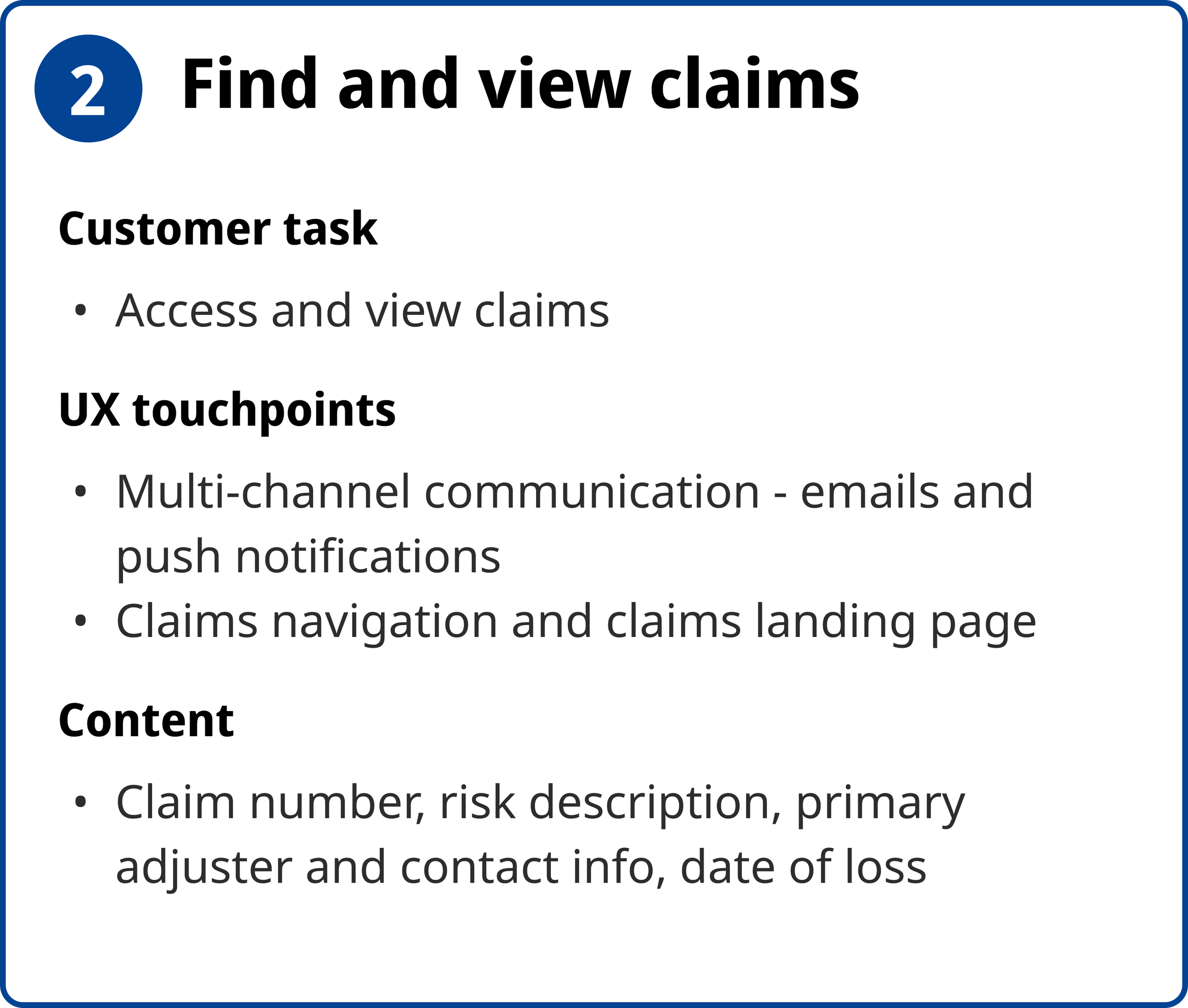

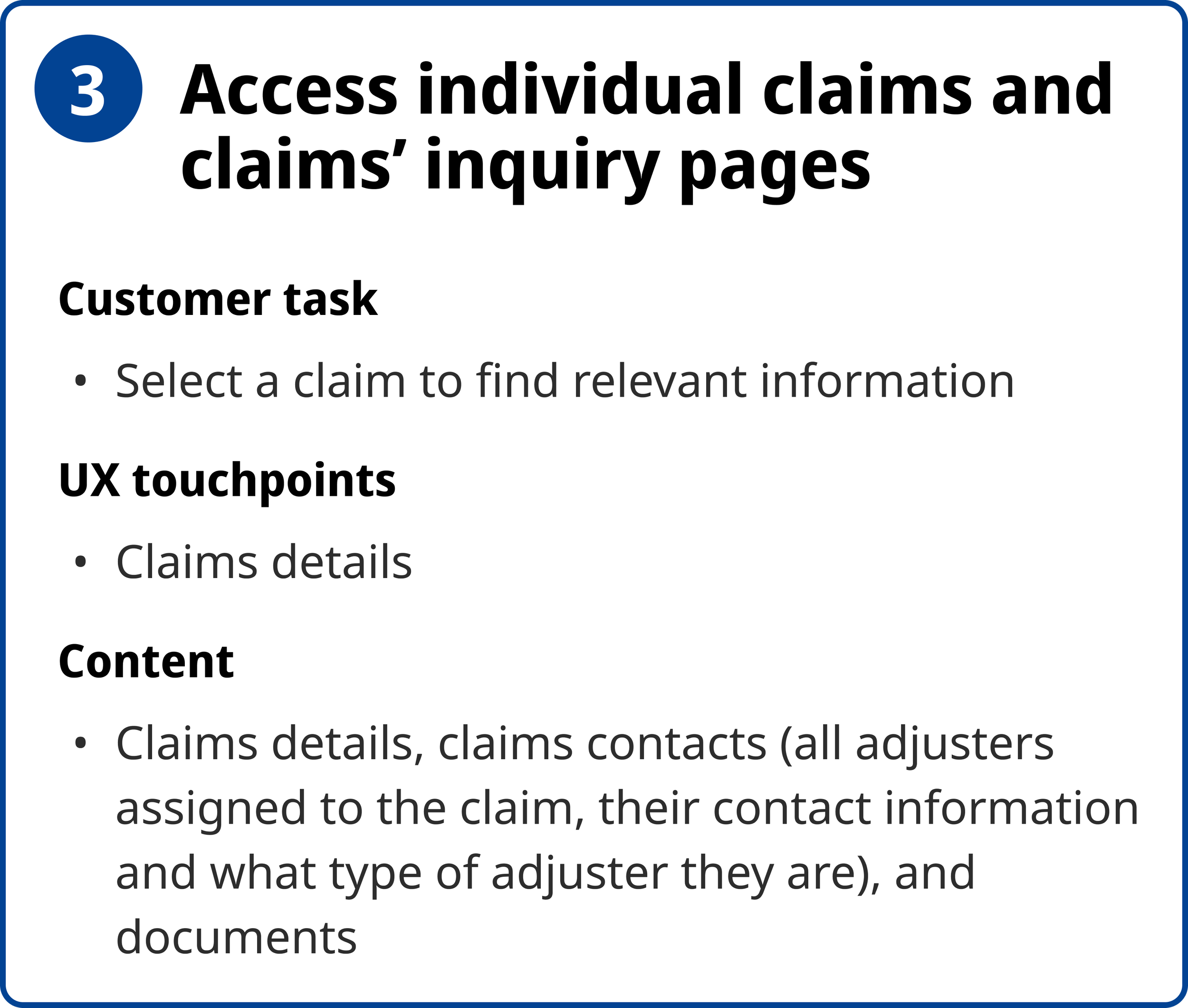

Designing the new claims journey

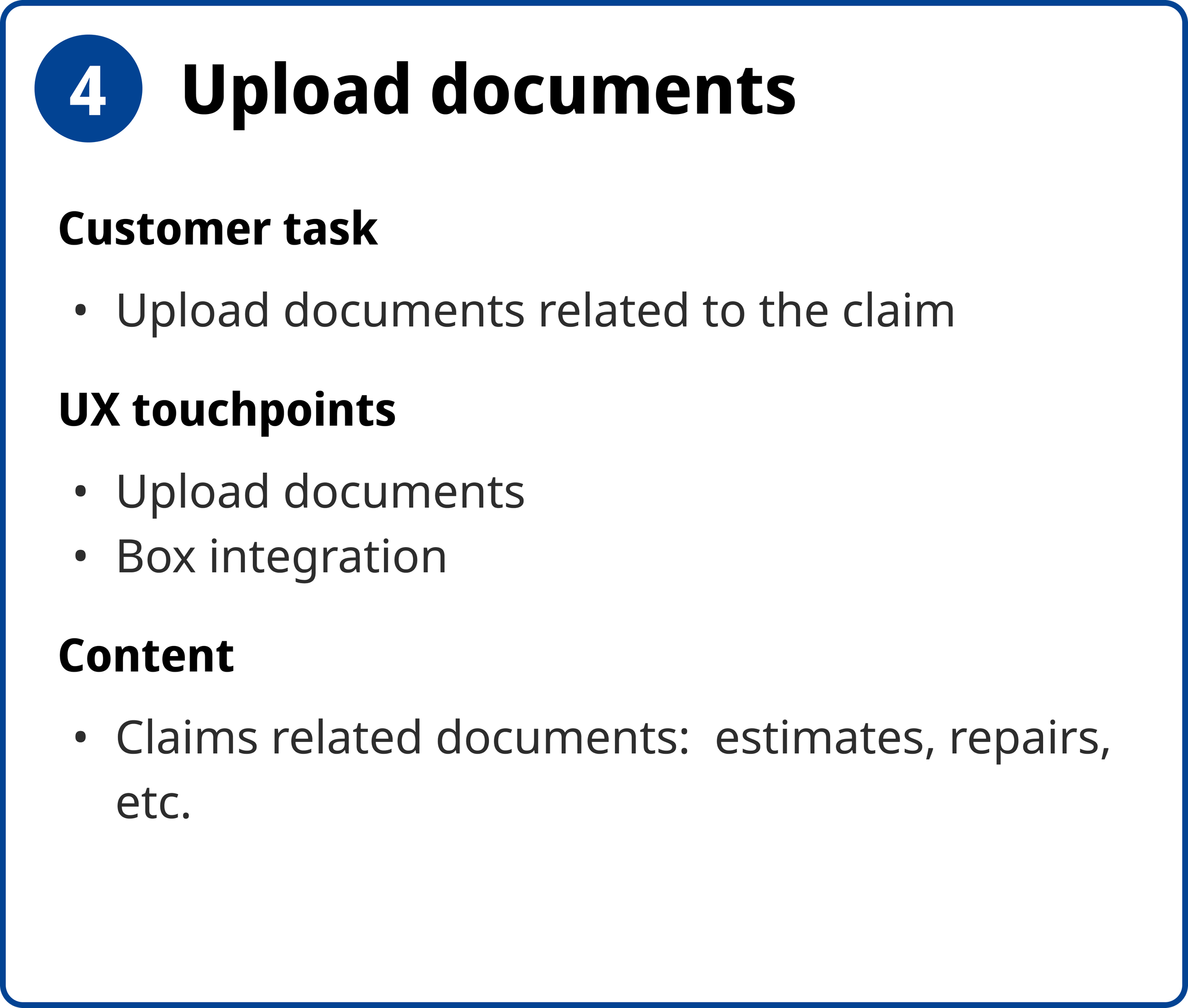

I consolidated the claim flow into 4 clear stages.

I identified the core customer tasks and designed touch points for each stage.

Start a claim

Find a claim

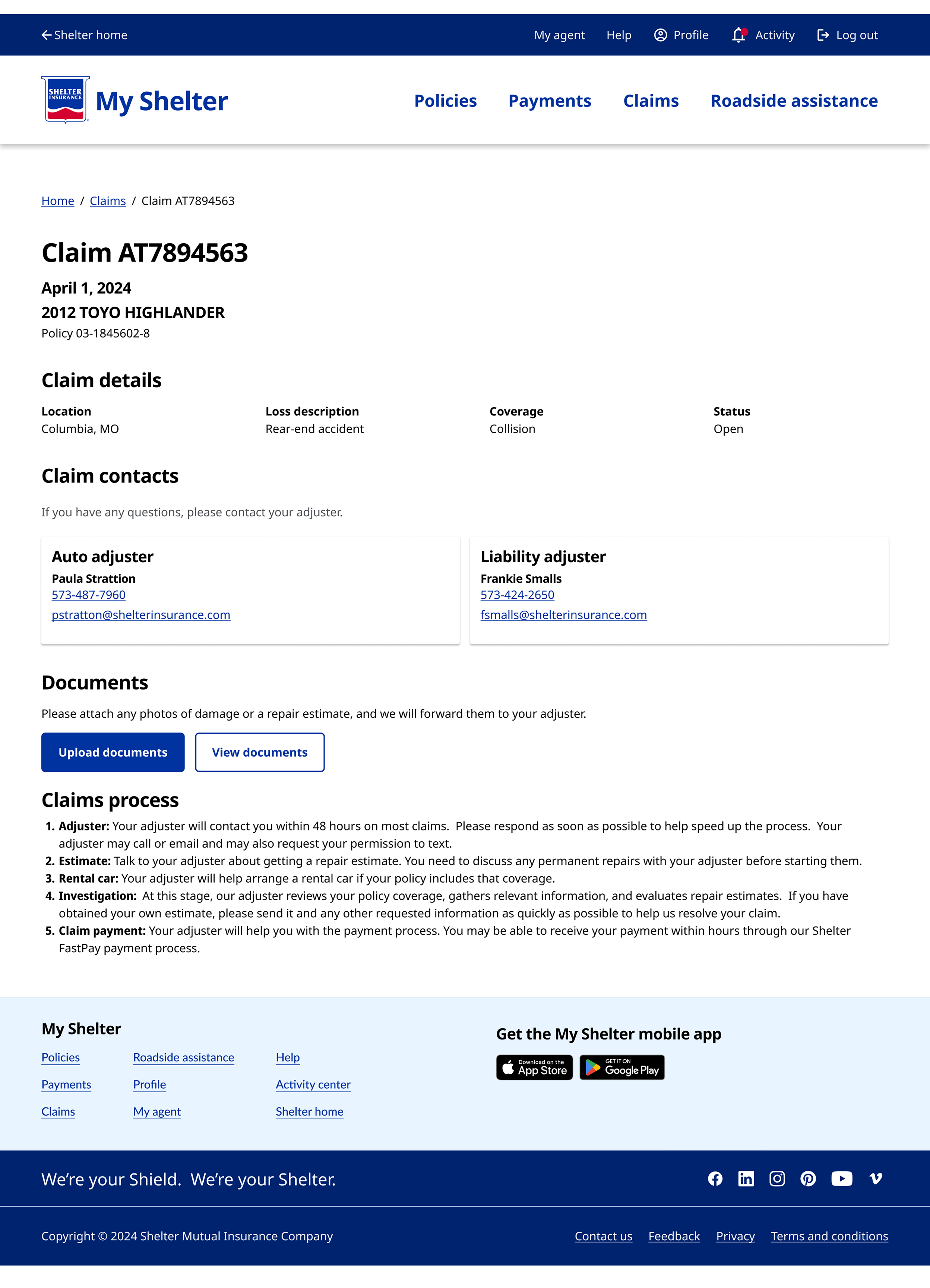

Access claim details

Upload documents

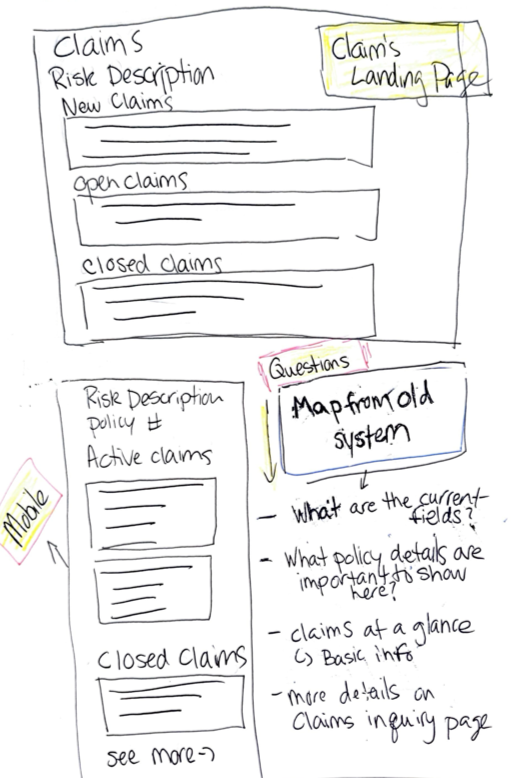

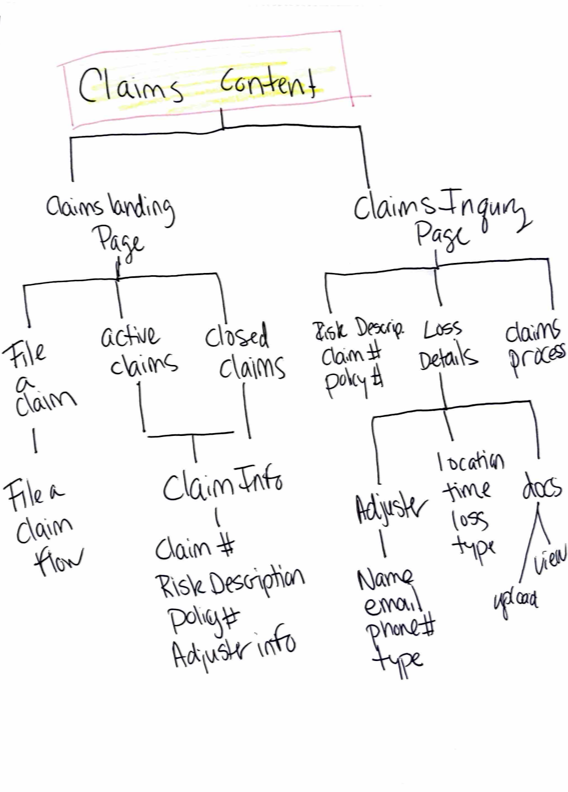

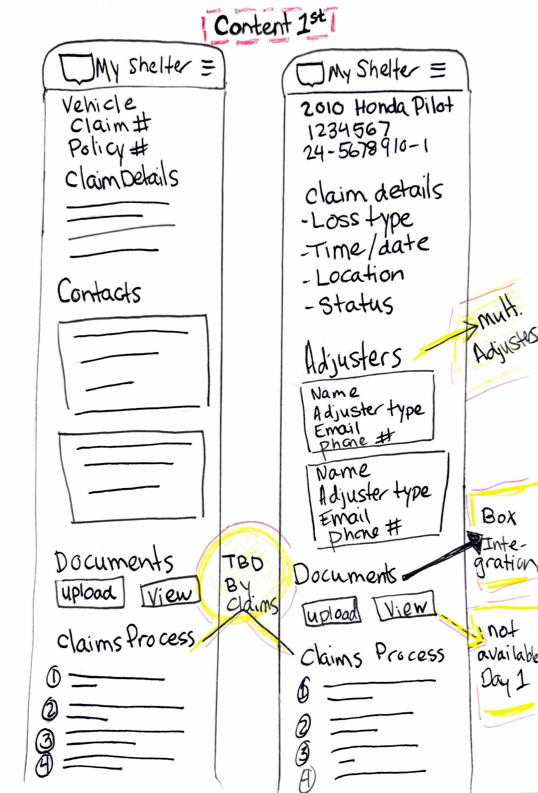

I explored layouts through quick sketches.

I sketched wireframes to test different layouts and information hierarchies. These mobile-first concepts helped me validate the structure before investing in detailed designs.

The transformation: From buried to accessible

After sketching concepts and gathering feedback from product owners, developers, and accessibility reviewers, I refined the designs to ensure they met both business goals and user needs. The final solution transformed how customers access their claims.

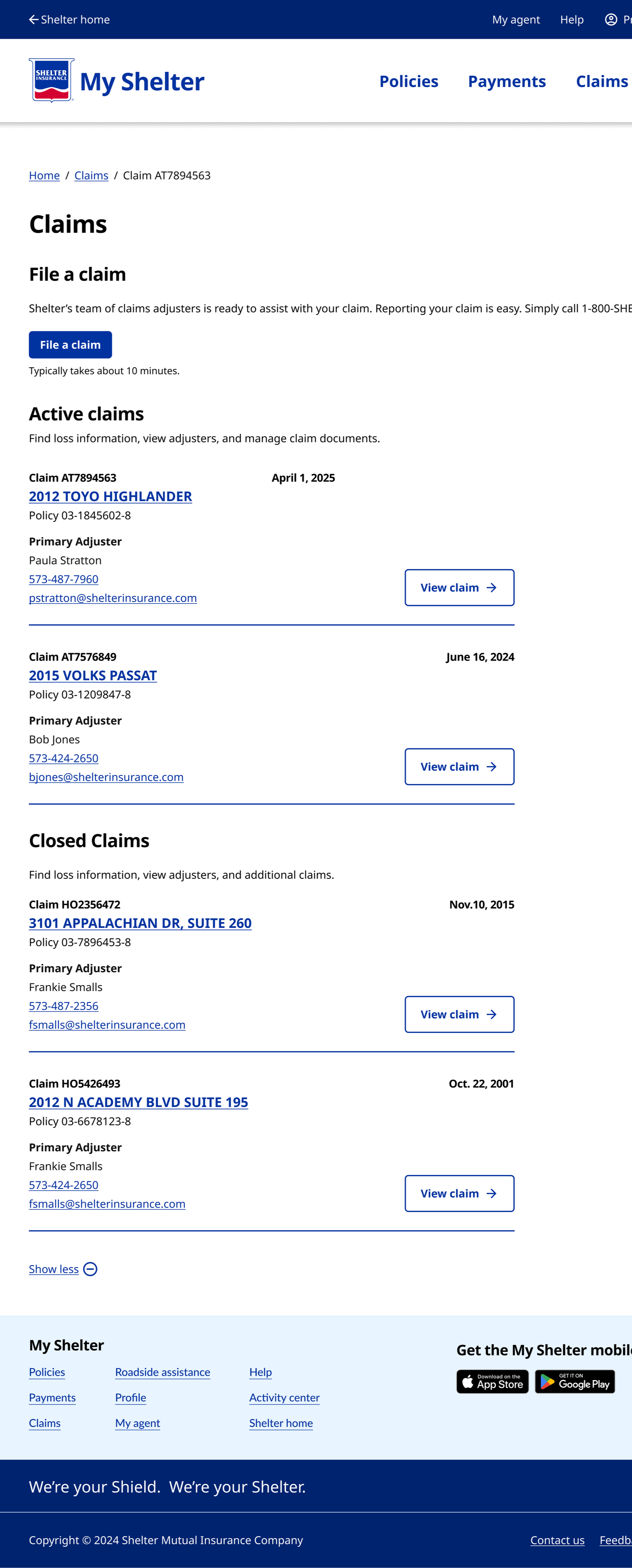

Claims list

Before: customers had to scroll through the policy inquiry page to locate their list of claims.

After: customers can now access all their claims on a single, dedicated page for quick and complete visibility.

Claims details

Before: customers could only see brief snippets of their claim details after expanding a drop-down on the policy details page.

After: customers can now view complete claim details on a dedicated page, ensuring full transparency and easy access.

The new claims experience

The final design empowers customers to quickly understand and manage their claims by introducing a clear, user‑friendly dashboard supported by focused, informative detail pages.

Prototype demonstrating the claims landing page and claim details experience.

Mobile claims landing page providing quick access to filing a claim and reviewing active claims.

Mobile claim detail view optimized for readability, showing the claim’s status, coverage, loss information, and contact details.

Impact metrics

Claims-related calls dropped from 25% to 15% of total customer service volume.

Customers have easier access to all of their claim information once logged into their accounts.

Clear communication around the claims process created visibility and trust with our users.