Built Shelter's design system from scratch, cutting dev time by 50%

Every team was recreating inconsistent components. Designers and developers across Shelter were recreating identical components for every project. No shared standards, no reusable code—just wasted time and inconsistent interfaces.

I researched the best systems and adapted them for Shelter. Studied IBM, Material, Clarity, and Adobe's design systems to find patterns that fit our needs. I partnered with engineering to design and build reusable components across React, Angular, and vanilla web.

Impact:

50% reduction in dev task time

First unified design system at Shelter

Now used across all internal and customer-facing products

Shelter Insurance didn't have a design system.

Designers recreated the same components for every project, engineers built duplicate code, and insurance customers navigated inconsistent interfaces.

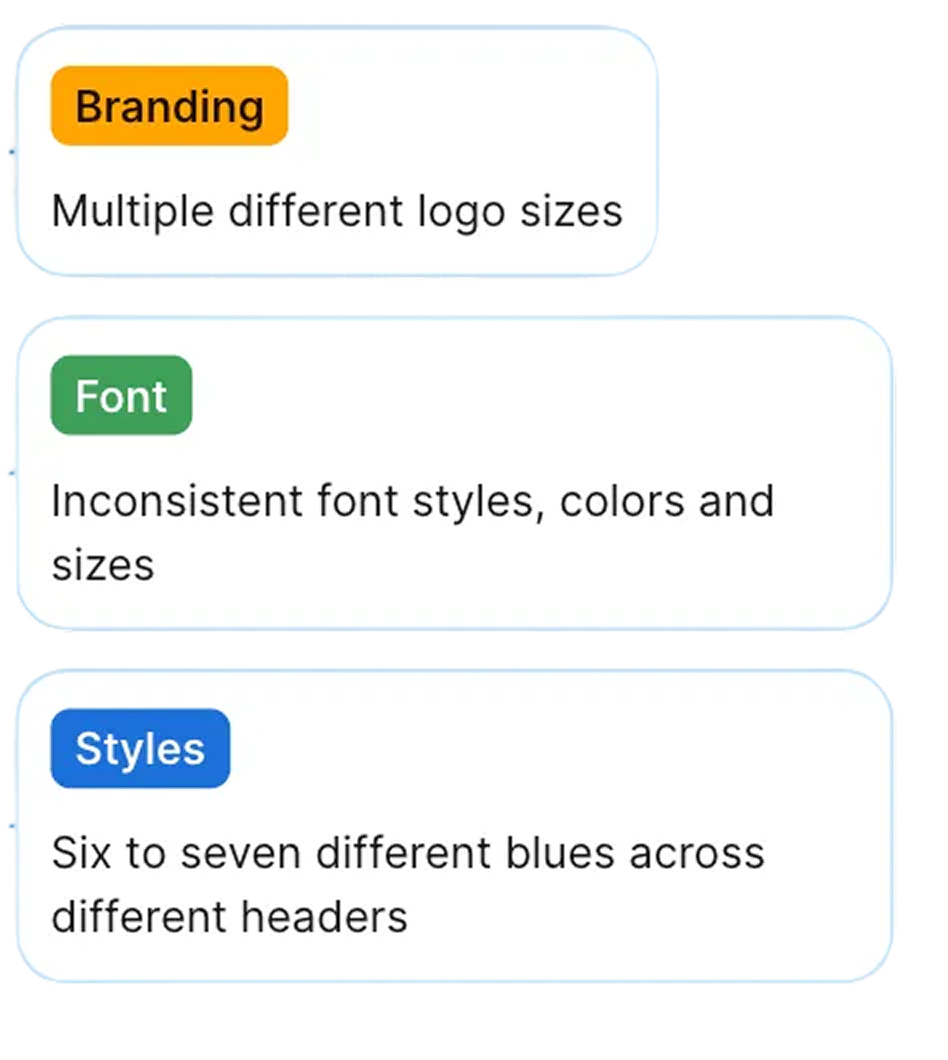

Visual inconsistencies across Shelter's digital products:

Brand inconsistency across channels: Shelter Insurance's print materials and digital assets followed different styles, varying in color palette, typography, and logo treatments, resulting in inconsistencies in the overall brand experience.

Development inefficiency: Each team spent 9-10 hours per week recreating buttons, forms, and navigation components that already existed elsewhere—time that could have been invested in building new customer-facing features.

Fragmented customer experience: Varying button styles, typography, and layouts across pages created a disjointed digital ecosystem that didn't reflect Shelter's strong brand standards.

These inconsistencies slowed product development, fragmented Shelter's brand identity, and created a digital experience that didn't match the quality of Shelter's insurance products.

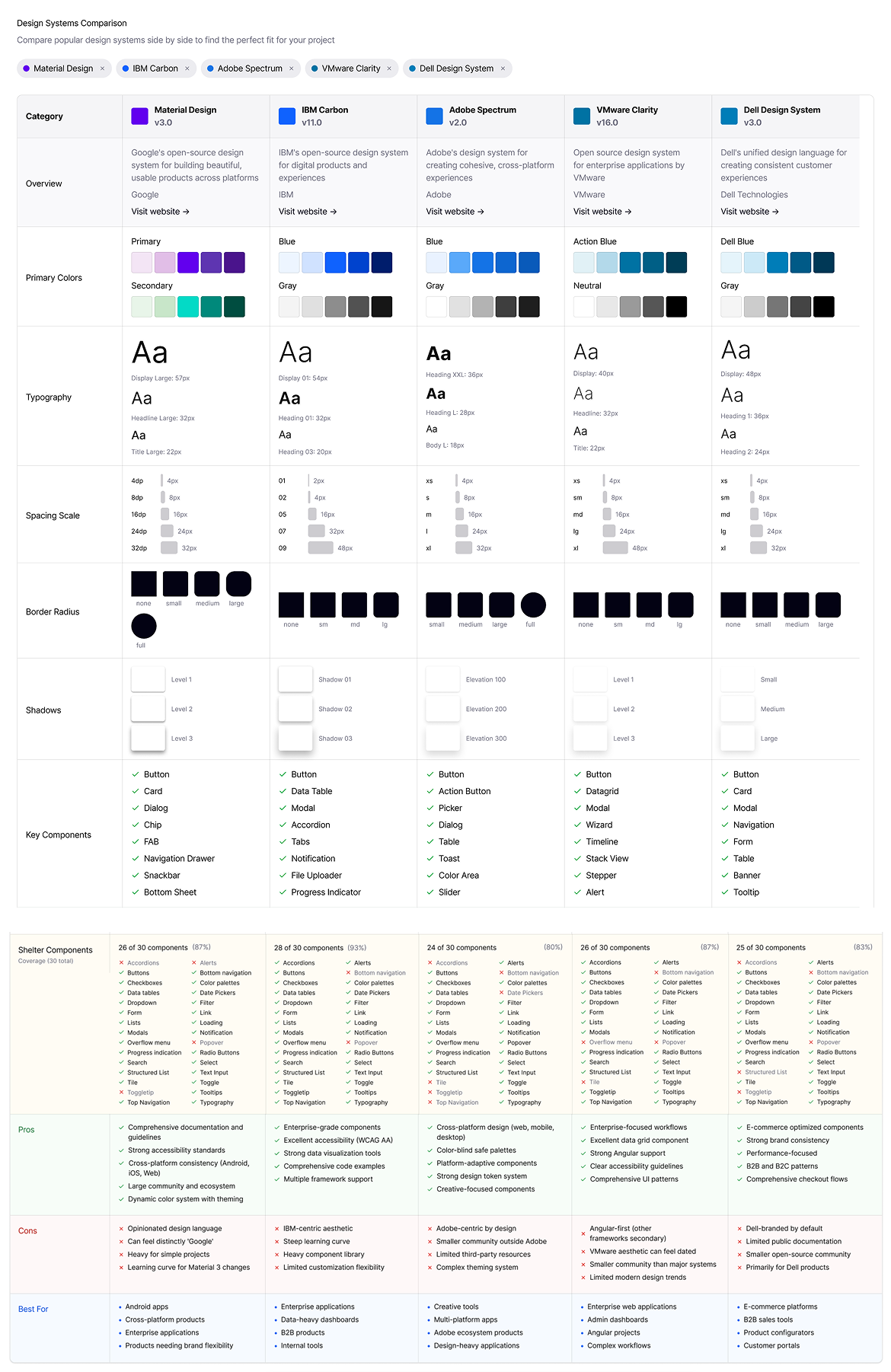

Learning from IBM, Material, and Adobe: choosing the right foundation

Evaluating proven design systems to find Shelter's path

Before building Shelter's design system, I needed to understand what already worked at enterprise scale. I analyzed five established design systems, each chosen for specific reasons:

The winner: Material Design as our foundation

Why these five systems:

IBM Carbon - Enterprise-scale documentation and governance model; proven in insurance/finance industries

Material Design (Google) - Comprehensive component library with strong multi-framework support (React, Angular, Web Components)

Clarity (VMware) - Enterprise application focus with data-dense interface patterns

Dell Design System - Multi-brand consistency approaches for organizations with varied product lines

Adobe Spectrum - Accessibility-first methodology and comprehensive design token architecture

I selected Material Design as Shelter's architectural foundation because:

Multi-framework support across React, Angular, and vanilla web

User familiarity—customers already know Google's component patterns

Extensive documentation and examples to learn from

Wide range of base components (50+) to build upon

However, we didn't rely on Material's defaults. I customized the system to Shelter's brand by adapting colors, typography, and component styling, while building accessibility into each component.

Building accessible, reusable components

With Material Design as our foundation, I partnered with developers to design and build a comprehensive component library that would work across React, Angular, and vanilla web.

From wireframes to production-ready components

I began with low-fidelity wireframes to establish component hierarchy and patterns, working closely with developers to validate technical feasibility and identify which components would deliver the most value.

Hand drawn sketches

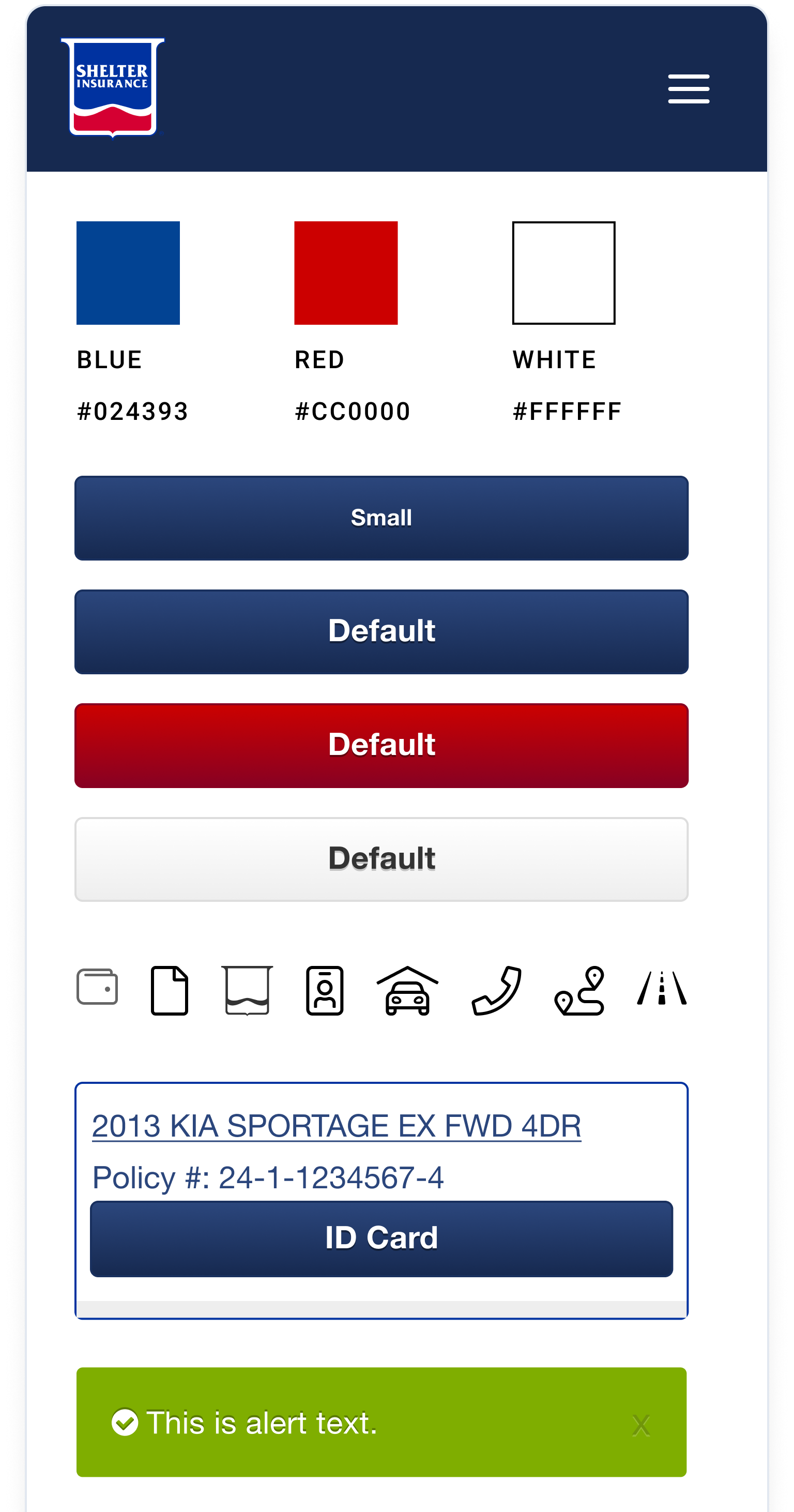

Before:

Key improvements included:

Low-fidelity component library

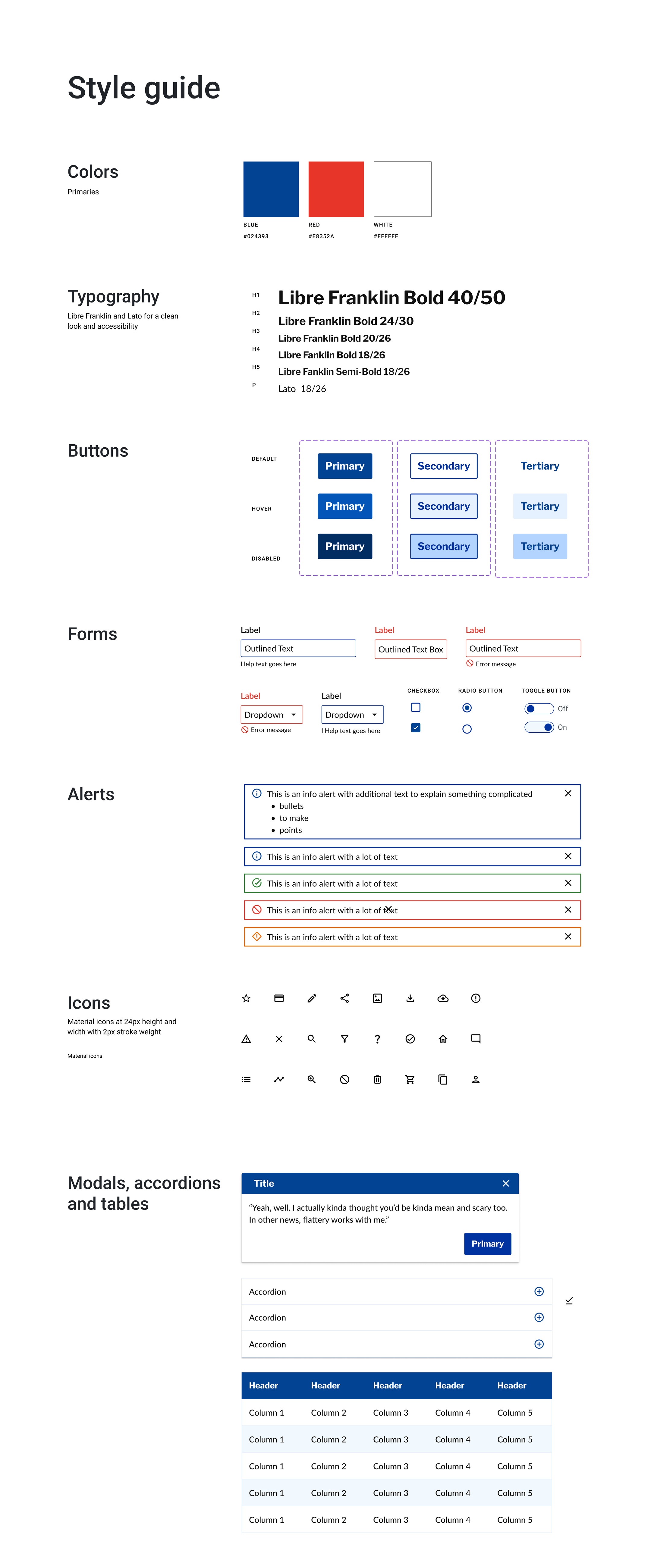

High-fidelity style guide

These hand-drawn wireframes evolved into digital components through close collaboration with engineering teams. The low-fidelity component library (center) translated sketches into basic patterns—establishing button hierarchy, form structures, navigation systems, and layout grids—allowing developers to validate technical feasibility before adding visual polish.

These basic components were then refined into the final style guide, which established Shelter's brand palette, typography (Libre Franklin Bold), and standardized form patterns—all refined through developer feedback, accessibility testing, and brand alignment.

Transforming inconsistent patterns into a unified system

The design system transformed Shelter's fragmented digital experience into a cohesive, accessible system.

After:

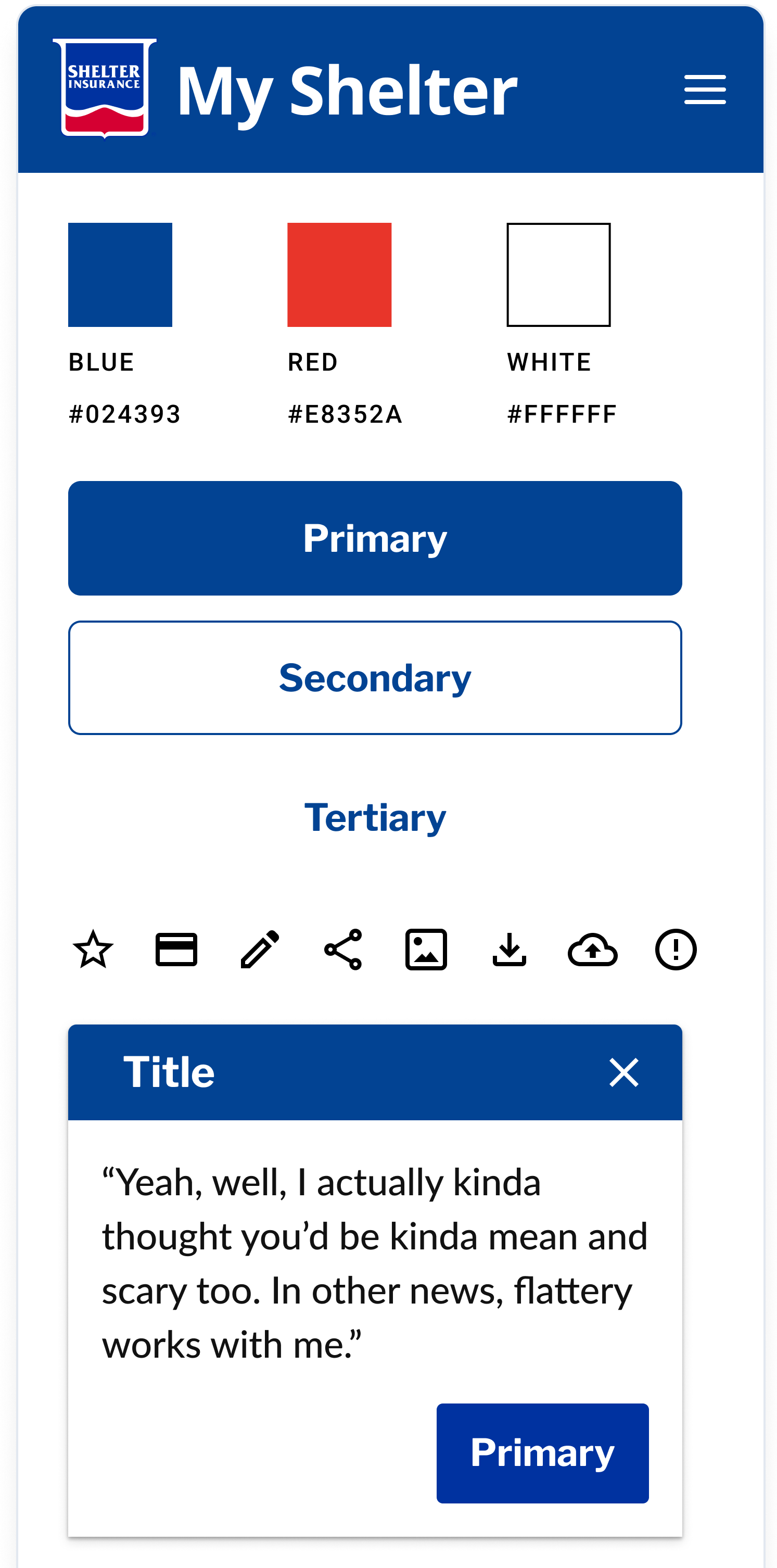

Clear branding:

Added "My Shelter" text to the header for immediate brand recognition and user orientation

Refined color palette:

Updated red from

#CC0000to#E8352Afor better accessibility and brand consistencyMaintained Shelter Blue (

#024393) and white as the core palette

Semantic button hierarchy:

Replaced vague labels (Small, Default) with clear semantic naming (Primary, Secondary, Tertiary)

Established visual hierarchy through filled buttons for primary actions, outlined for secondary, text-only for tertiary

Standardized components:

Created a reusable modal pattern with a consistent header, close button, and action placement

Unified icon system with consistent sizing and visual weight

Established component naming conventions for easier implementation

Design system in action

The design system was applied across Shelter's digital products, transforming fragmented experiences into cohesive, accessible tools for insurance customers. Here's how it improved three critical customer touchpoints

From prototype to production: validating the system

Real-life application

DS components prototype

Interactive prototypes built with design system components allowed us to validate patterns with stakeholders and policyholders before development began. This prototype-to-production approach ensured the system worked in real-world scenarios while accelerating development

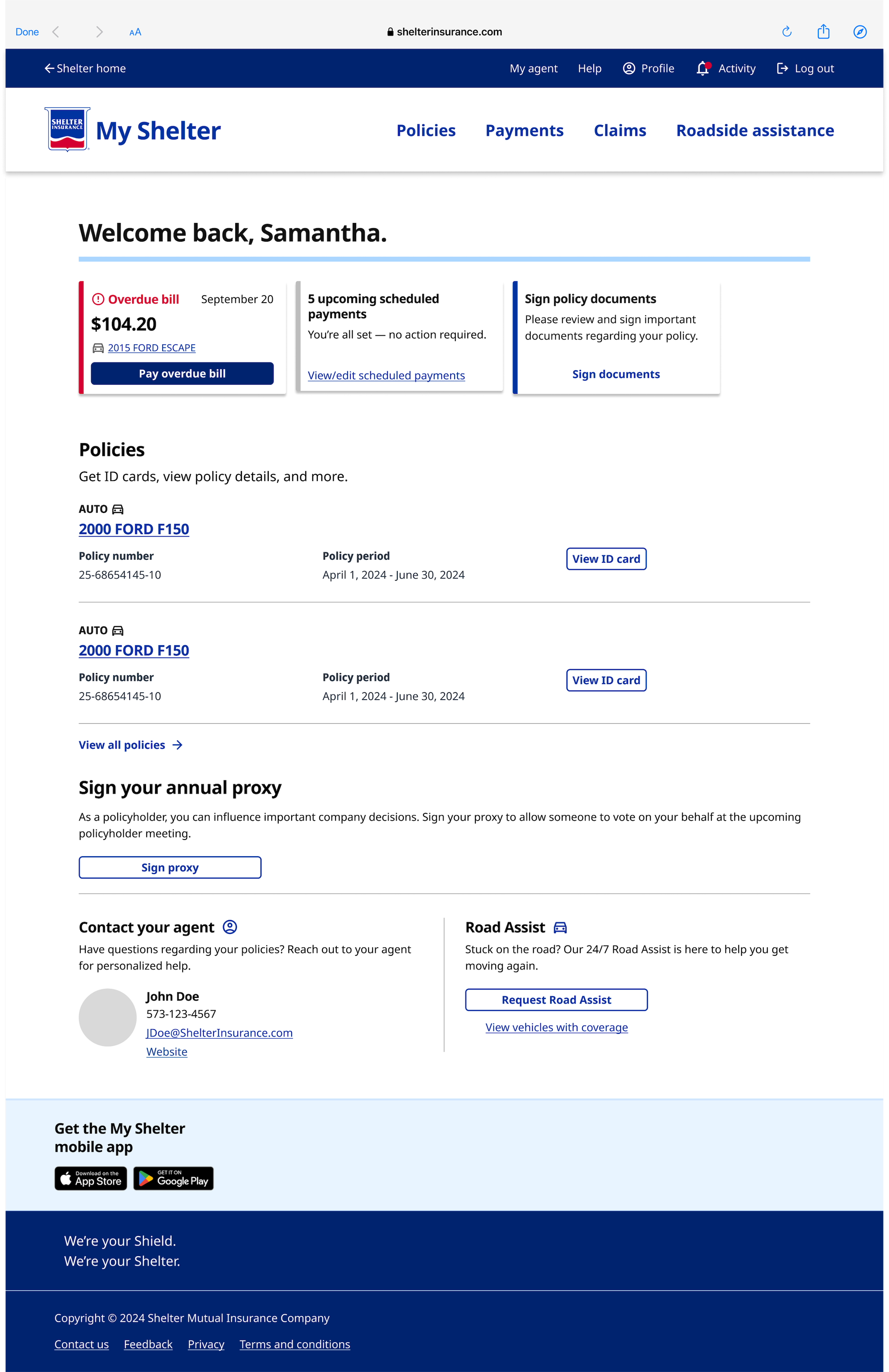

Customer dashboard: Improving navigation and clarity

The dashboard redesign demonstrates how the design system's standardized components created a more intuitive customer experience.

Before:

After:

Previous features:

Relied on page-level alerts

Red buttons created friction

Poor hierarchy

New features:

Card-based messaging

Improved top navigation

clear call-to-action

Strong content hierarchy that enhances usability and clarity

These examples demonstrate how the design system transformed both new and existing products—creating consistency, improving usability, and accelerating development across Shelter's digital ecosystem.

Impacts and outcomes

50% reduction in development time

5 products launched using the design system

Streamlined design-to-development handoff through standardized documentation and reusable components

Established a consistent brand experience across customer-facing products and internal tools